- 15 Feb 2018 22:00

#14889379

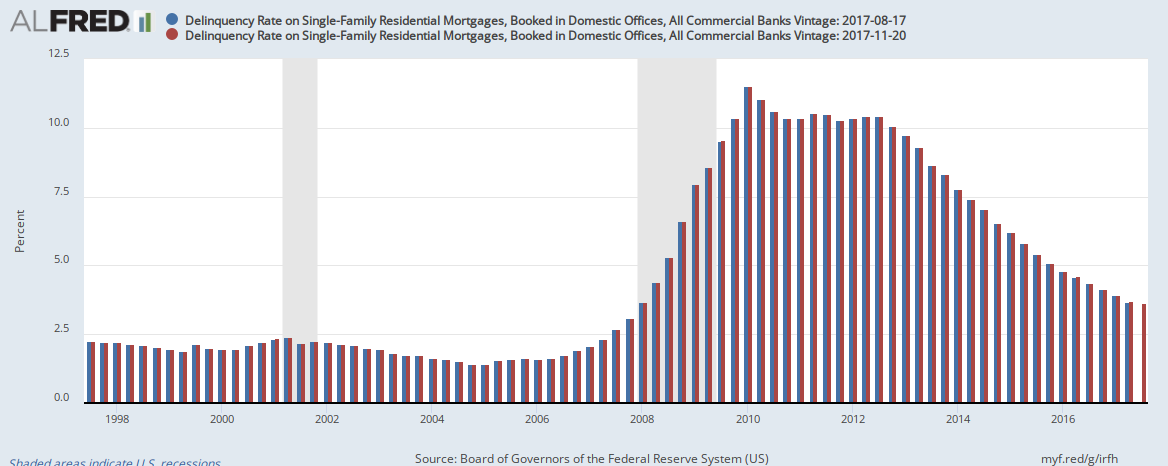

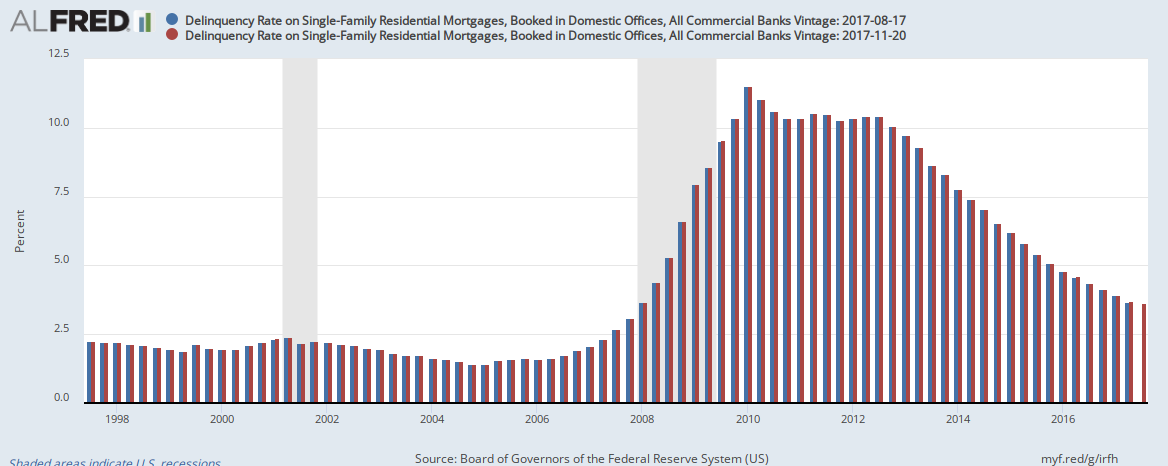

Randomly browsing data, I just found this. (Interactive chart: https://alfred.stlouisfed.org/series?seid=DRSFRMACBS).

Mortgage delinquency rates did not fall below the delinquency rates for Q1 2008, until Q3 of 2017 (the last quarter for which data are available).

Note that in an historical context default rates have remained extraordinarily high through to the present.

And then there is this:

Mortgage rates climb to their highest levels in nearly four years

It would take a bit of analysis to determine the true nature of any similarities which might attain between the current situation and the situation in 2008.

What is fundamentally changed in this millennium from an historical standpoint seems to be the generalized 'financialization' of the housing sector. Financialization is a somewhat clunky term, but does have real meaning in these contexts. Houses have been converted into (to an extent larger than previous periods which is significant) financial assets--the scope and magnitude of financial considerations connected to residential real property have undergone processes of intensification; and these are partly related to financial structures (for example, financial derivatives).

There are also attendant large concerns attainable from my perspective, related to the volatility now extant in real property (as well as treasury bonds). The loss of sanguine alternatives to speculative finance (an extant broad phenomenon over recent decades) is likely to be consequential indeed, including from a systemic standpoint.

Mortgage delinquency rates did not fall below the delinquency rates for Q1 2008, until Q3 of 2017 (the last quarter for which data are available).

Note that in an historical context default rates have remained extraordinarily high through to the present.

And then there is this:

Mortgage rates climb to their highest levels in nearly four years

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average shot up to 4.38 percent with an average 0.6 point. (Points are fees paid to a lender equal to 1 percent of the loan amount.) It was 4.32 percent a week ago and 4.15 percent a year ago. The 30-year fixed rate last hit this height in April 2014.

The 15-year fixed-rate average jumped to 3.84 percent with an average 0.5 point. It was 3.77 percent a week ago and 3.35 percent a year ago. The five-year adjustable rate average rose to 3.63 percent with an average 0.4 point. It was 3.57 percent a week ago and 3.18 percent a year ago.

It would take a bit of analysis to determine the true nature of any similarities which might attain between the current situation and the situation in 2008.

What is fundamentally changed in this millennium from an historical standpoint seems to be the generalized 'financialization' of the housing sector. Financialization is a somewhat clunky term, but does have real meaning in these contexts. Houses have been converted into (to an extent larger than previous periods which is significant) financial assets--the scope and magnitude of financial considerations connected to residential real property have undergone processes of intensification; and these are partly related to financial structures (for example, financial derivatives).

There are also attendant large concerns attainable from my perspective, related to the volatility now extant in real property (as well as treasury bonds). The loss of sanguine alternatives to speculative finance (an extant broad phenomenon over recent decades) is likely to be consequential indeed, including from a systemic standpoint.

- By Pants-of-dog

- By Pants-of-dog