Rancid wrote:It's generally accepted that the market has been overbought. Then you have people that keep saying the bond market is a bubble and this could be the beginning of the bubble bursting.

Fundamentally, the economy still looks good, so it's not unreasonable to think it's still just a correction.

I don't think anything about the economy looks 'fundamentally good'. That phrase seems to me like pundit claptrap that actually mean nothing at all.

Here is a potential explanatory narrative which has been forming itself in my mind. The huge spike in the stock market after the election of Trump accompanied by Republican majorities in the House and Senate was due to 2 factors. The main factor is that it was a relatively improbable event from the standpoint of the market. It is the improbable (from the standpoint of the collective consciousness among large speculators) which causes large market moves on the spot of exogenous information, which is broadly speaking basically a function of the 'casino' nature of the equity markets--the 'betting' nature of particular positions and transactions.

What was the substance of the spike? By now, we all know (though we also knew at the time--those of us who cared to read the financial press). It was the tax cut, which the market immediately priced in, on what was essentially their 'insider knowledge' on the near certainty of the tax cut being passed. Secondarily, the forthcoming cuts to regulation also became priced in.

Cutting taxes and cutting regulations are both the equivalent of pouring gasoline on a fire. With respect to tax cuts: every single quarterly or annual financial statement compiled by every single company, includes as one of the most key pieces of information, the balance sheet line 'EBITDA'. This stands for 'Earnings Before Interest, Taxes, Depreciation and Amortization'. This is the formula for calculating profits. Therefore, cutting taxes directly influences this formula. The removal of taxes thus becomes a direct transfer to share holders, through this financial infrastructure. It directly effects share prices upwardly, by directly defining profits up.

Regulations are pretty self explanatory. If you are shitting in a river, and a regulation is passed saying you must bag your shit and pay a truck driver to haul it to a land fill, and then a new regulation comes along repealing that last regulation, you are going to save a little money on now once again not paying the trucker. That's the basic principal. Now, expand 'shitting in a river' to as many examples you would like to think of, which are relevant to particular companies and/or industries.

From this standpoint, the cashing in of the bets on Trump/Republican election victories occurred on the spot of those victories. They were thus priced in, and a hostage situation ensued, whereby the collective will of the market became an overarching driver for the tax cuts being pushed through, lest the market should collapse on their not being actualized due to the actions taken on the markets' lofty initial expectations.

In the mean time, the supercharged stock market drove investment across the economy, resulting in artificially enhanced aggregate effective demand, I would guess especially for capital goods and services, but also probably to lesser extent for other items, including wage goods (just a guess). Thus, the unexpected wage growth may itself be a function (at least to an extent significant enough to warrant consideration) of the excesses within the financial sector.

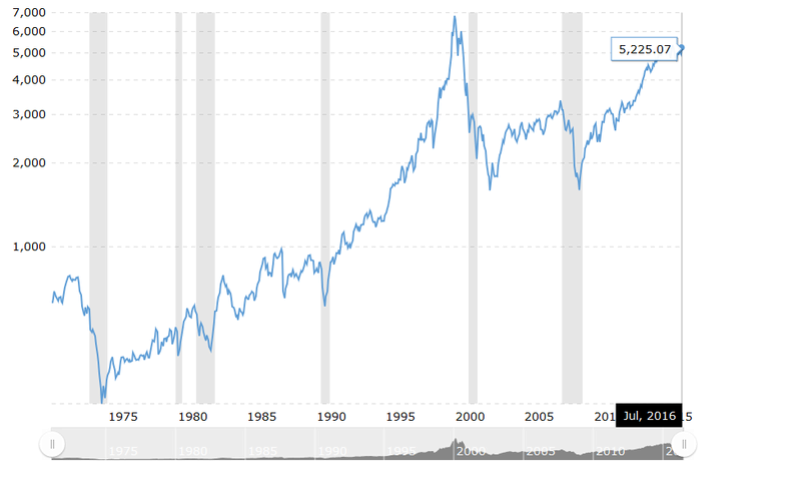

The bond market bubble would seem largely a function of the Fed's 0%-interest rate policy, in place ever since the last collapse. The demand for bonds as a function of the overcharged stock market, and desire for the sanguine alternative to stocks, and indeed merely the speculative nature of the financial sector, has led to significant money flowing into bonds. The effects of trading on bonds is more complex than stocks. What we seem have is a situation where persistent demand for bonds (mostly driven by the high returns on stocks--you take 100, turn it into 150 in a week, and buy 150 in bonds, where one week ago you might've only bought 100 worth, in lieu of that 50 in stock market gambling winnings). So therefore, the bond market becomes artificially inflated.

The over-inflated bond market complicates the job of the Fed considerably, and this is especially the case given that interest rates are already at 0% (and have been for years). They cannot go any lower. Nonetheless, to respond to inflation, the conventional policy is for the Fed to raise interest rates. Well and good. But wait, there's that bond bubble. If you raise interest rates now, bond yields will go higher (some audacious speculators are hoping for yields like 7%--or so I have heard, while engaging in self-harm by listening to Bloomberg Radio sometimes lately). Rising bond yields will slay the frenzied stock market activity. The activity on the stock market is bad, because it's frenzied, but we have a completely irrational economic arrangement, whereby the collapse of a stock bubble causes a bunch of economic hardship, because everybody's savings are now tied to the great Wall Street Casino.

There are additional circumstances at play. I think the Trump cabal has a simplistic view of economics, and they think that pursuing a weak dollar policy will lead to a surge in US exports, while they might not fully appreciate the complete spectrum of the effects that pursuing a weak dollar might have. Also, some of the declines in equity prices are directly attributable to the new tax code, because it included a large one-time payment on the part of many companies, which has actually resulted in quarterly losses, revealed at the time of the publications of their quarterly earnings reports. These days, many companies are reporting.

So, I don't have any advice, but what I am doing is I am flying to China on the 20th of this month, in order to start a new job there. I have some new student loans, and fortune might divine that when I eventually convert some of my Renminbi to pay off my loans, the US Dollar will have by than sufficiently depreciated vis-a-vis the Chinese Renminbi, so that the loans may in the end prove profitable, in some respects.

Please don't misunderstand this as my grand design to benefit if the US goes down, I worry about my friends and family who have equities and bonds, in the events of market downturns, and I am not actively engaged in speculation, much less speculation against the US. However, I use finance--though hopefully only do so sensibly. I see engaging with contemporary finance essentially as taking a boxing match, where the main goal is just to hit and not get hit. I suppose I am fortunate that I use to box.

- By Tainari88

- By Tainari88 - By wat0n

- By wat0n