- 24 May 2018 07:02

#14917519

That is neither here nor there.

Even if you are right, after it paid the interest with the taxes as you claim, it turned around and borrowed the money back to put it back where it could be spent on something else.

The deficit is more than the interest on the debt.

Even for a household, if it will *always* be able to borrow it back after it pays its interest bill with its wages; it means it isn't really paying it with wages. Note the 'always'.

You might as well claim that the bonds that come due on any given day are paid off with tax revenue and then new bonds are sold to pay for all the other stuff the Gov. spends on. But, then abortions could not be paid with tax money they would have be paid for with newly borrowed money.

To me it makes more sense to say the bonds are just rolled over and/or reborrowed.

Crantag wrote:The fashionable view on this forum is that it is a perfectly healthy and normal arrangement that the US has devolved into a society based on monopoly money.

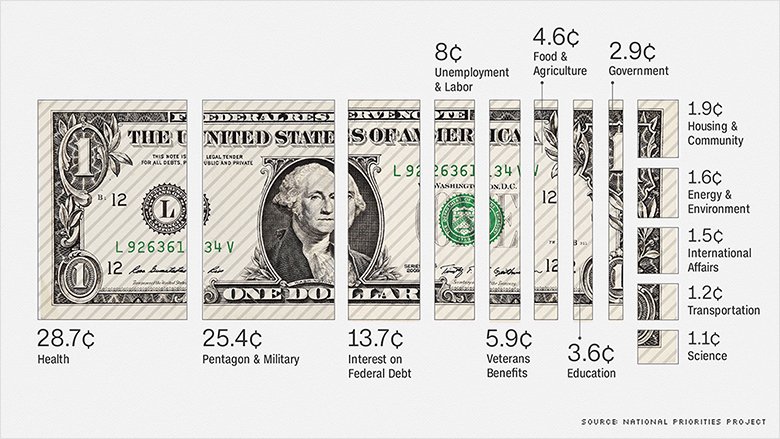

Steve American, you are flat wrong. Taxes are used to service the national debt.

A picture speaks a thousand words.

http://money.cnn.com/2016/04/18/pf/taxe ... index.html

That is neither here nor there.

Even if you are right, after it paid the interest with the taxes as you claim, it turned around and borrowed the money back to put it back where it could be spent on something else.

The deficit is more than the interest on the debt.

Even for a household, if it will *always* be able to borrow it back after it pays its interest bill with its wages; it means it isn't really paying it with wages. Note the 'always'.

You might as well claim that the bonds that come due on any given day are paid off with tax revenue and then new bonds are sold to pay for all the other stuff the Gov. spends on. But, then abortions could not be paid with tax money they would have be paid for with newly borrowed money.

To me it makes more sense to say the bonds are just rolled over and/or reborrowed.

- By Rich

- By Rich