- 01 Dec 2023 03:04

#15297207

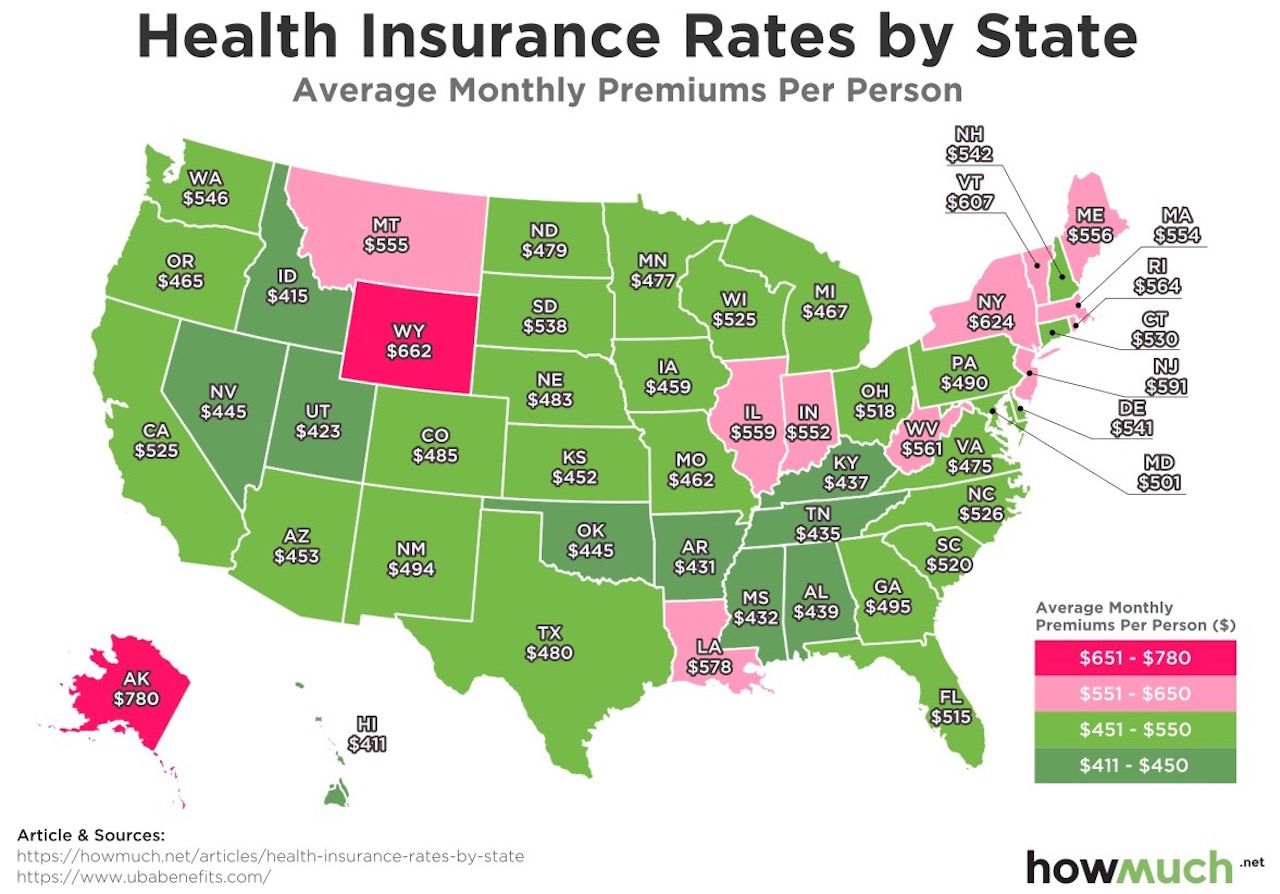

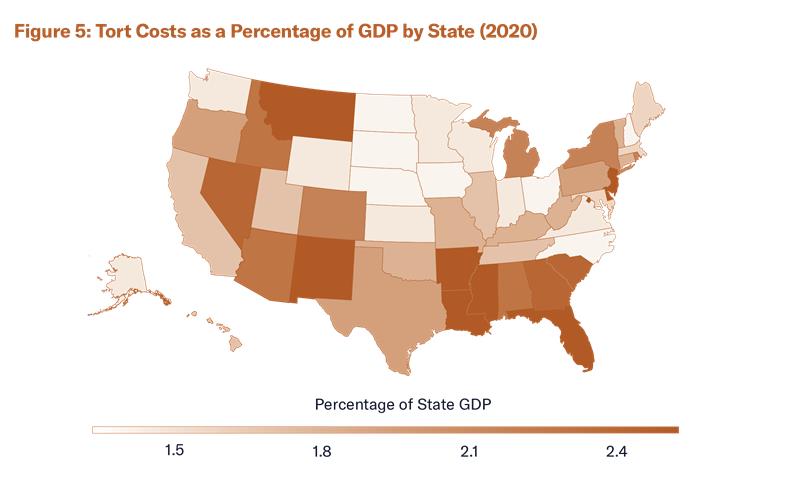

For those of you who have wondered why insurance costs are so high in Progressive Left-leaning states, take a look at this.

Opinion: California Class-Action Lawyers Now Targeting Life Insurance Industry

After a brief two-year hiatus, California once again reclaimed the top spot in the latest Judicial Hellholes list in December 2021. The annual report released by the American Tort Reform Foundation shines a spotlight on the worst civil justice climates across the country.

California has little hope of removing itself from the top of this list as it continues to embrace novel theories of liability that dramatically undermine the state’s business environment and economic growth.

Widespread lawsuit abuse continues to wipe out billions of dollars of economic activity annually. The most recent economic data reports that every California resident pays a “tort tax” of $1,917 as a result of the state’s broken civil justice system. Unfortunately, for California residents and businesses, their tort tax is likely to get worse before it gets better.

For years, the trial bar in California has taken advantage of the state’s lucrative financial incentives for launching frivolous class action lawsuits. Now, they are turning their attention to a new target: lapsed life insurance policies.

The article goes on to describe a state Supreme Court ruling that applied a new law retroactively, which is unfair to those trying to play by the rules and violates the presumptions inherent in contract law.

The trial bar saw its opportunity to score a major new payday by opening the floodgate on class action lawsuits against life insurance companies.

What many don't realize is that these class action settlements far too often provide little to no benefit to class members, but instead serve to enrich the trial lawyers who bring these suits.

Opinion: California Class-Action Lawyers Now Targeting Life Insurance Industry - Times of San Diego, Tiger Joyce, July 9, 2022

Maybe what those on the Progressive Left do not understand is that when companies have to pay out ridiculous multi-million dollar lawsuits, everyone pays for that.

Plenty of related other threads about ridiculous lawsuits:

Car insurance company must pay for woman catching disease from her boyfriend

Court orders utility company to pay billions of dollars for fire

Jury awarded black worker $137 million in lawsuit for being called N-word

Opinion: California Class-Action Lawyers Now Targeting Life Insurance Industry

After a brief two-year hiatus, California once again reclaimed the top spot in the latest Judicial Hellholes list in December 2021. The annual report released by the American Tort Reform Foundation shines a spotlight on the worst civil justice climates across the country.

California has little hope of removing itself from the top of this list as it continues to embrace novel theories of liability that dramatically undermine the state’s business environment and economic growth.

Widespread lawsuit abuse continues to wipe out billions of dollars of economic activity annually. The most recent economic data reports that every California resident pays a “tort tax” of $1,917 as a result of the state’s broken civil justice system. Unfortunately, for California residents and businesses, their tort tax is likely to get worse before it gets better.

For years, the trial bar in California has taken advantage of the state’s lucrative financial incentives for launching frivolous class action lawsuits. Now, they are turning their attention to a new target: lapsed life insurance policies.

The article goes on to describe a state Supreme Court ruling that applied a new law retroactively, which is unfair to those trying to play by the rules and violates the presumptions inherent in contract law.

The trial bar saw its opportunity to score a major new payday by opening the floodgate on class action lawsuits against life insurance companies.

What many don't realize is that these class action settlements far too often provide little to no benefit to class members, but instead serve to enrich the trial lawyers who bring these suits.

Opinion: California Class-Action Lawyers Now Targeting Life Insurance Industry - Times of San Diego, Tiger Joyce, July 9, 2022

Maybe what those on the Progressive Left do not understand is that when companies have to pay out ridiculous multi-million dollar lawsuits, everyone pays for that.

Plenty of related other threads about ridiculous lawsuits:

Car insurance company must pay for woman catching disease from her boyfriend

Court orders utility company to pay billions of dollars for fire

Jury awarded black worker $137 million in lawsuit for being called N-word

- By Istanbuller

- By Istanbuller