- 03 Jun 2022 13:53

#15231391

36% Of Americans Making $250,000 Are Living Paycheck To Paycheck

Over a third of Americans who make at least $250,000 per year say they're living paycheck to paycheck, which Bloomberg suggests underscores how inflation is 'taking a bigger bite out of Americans' budgets at all ends of the pay spectrum.'

Another interpretation is that Americans makig at least $250,000 - placing them in the top 5% of earners in the country - have horrendous financial literacy.

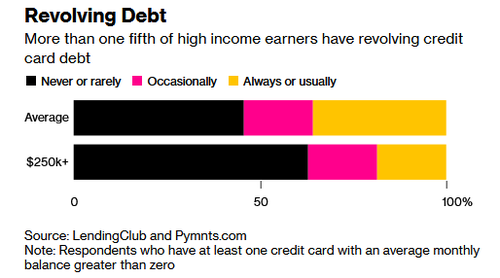

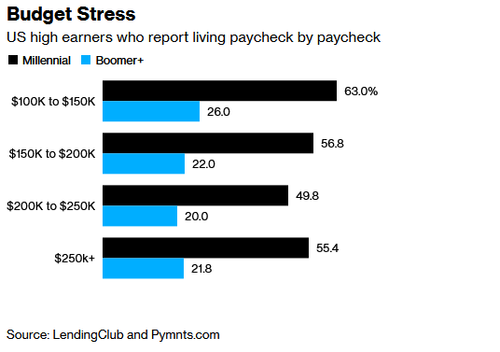

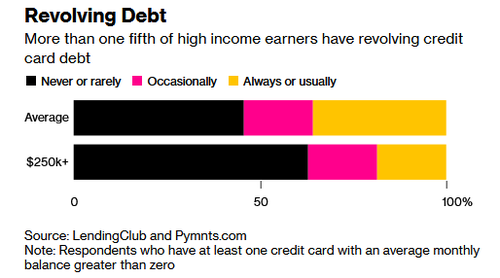

According to a survey by Pymnts.com and LendingClub, some 36% of households who make at least $250k - nearly 4x the median US salary - devote almost all their income to household expenses. Higher-income households are also more likely to put expenses on credit cards, though they're also more likely to be able to pay off their balance in full.

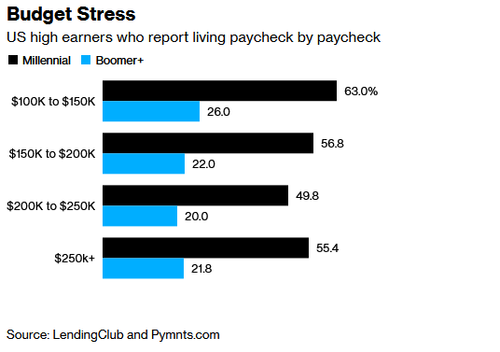

The most squeezed people in the high-income category are millennials - those in their mid-20s to early 40s. Over half of top earners in that generation report having very little left at the end of each month.

That said, LendingClub is quick to note that paycheck-to-paycheck doesn't necessarily mean hardship - in fact, only 10% of high earners reported issues covering all their household expenses in April - but it does mean they would have to radically adjust their lifestyle in the event their income suddenly goes away.

Housing expenses, which typically take up large chunks of the budgets of wealthier people, have skyrocketed during the pandemic. For example in Orange County, California, a top-tier home cost $1.7 million in April, up from $1.2 million in February 2020, based on Zillow Group Inc. data. A mortgage on that house, assuming a 20% down payment, would cost about $100,000 per year. That’s 40% of a $250,000 annual pre-tax income.

Top earners, even those struggling to pay the bills, are of course much better off than the rest of the nation, which is facing soaring prices for everything from food to gas and electricity. -Bloomberg

Aside from high-earners, 61.3% of all consumers surveyed reported living paycheck-to-paycheck, up 9% from a year earlier, as US consumer borrowing has soared. In March, credit-card balances spiked by the most on record, and non-revolving credit jumped as well.

Meanwhile, 25% of Americans are delaying retirement due to inflation, a new survey by BMO has found.

Putting off retirement plans is mostly due to disrupted savings from increased prices, the survey found. Thirty-six percent of survey respondents have reduced their savings and 21% are putting away less for retirement in order to keep up with growing costs, according to the survey. -CNBC

"We haven’t seen this level of inflation in a very long time, and it’s very daunting," said Paul Dilda, head of consumer strategy at BMO Harris Bank, who added that many people who are either retired or are nearing retirement didn't factor in surging expenses.

Inflation has affected younger Americans the most - with over 60% of those between 18 and 34 years of age reporting that they had to pull back on their savings contributions in order to offset the rising costs.

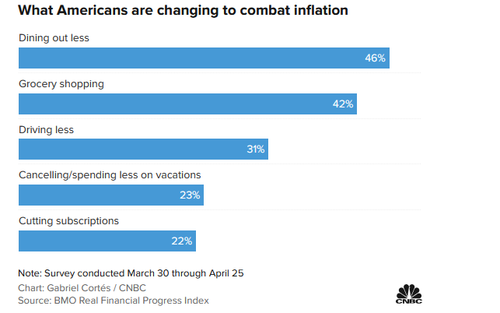

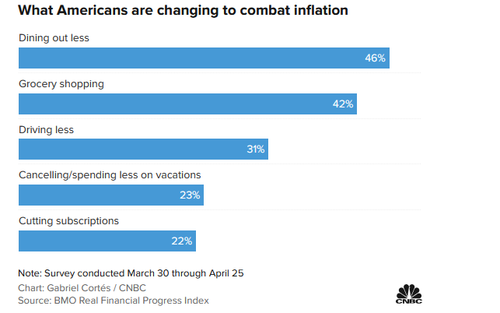

What are people doing to combat inflation? Americans are dining out less, being more careful at the store, driving less, and canceling or spending less on vacations.

"We’re seeing a lot of people taking those actions so that they can continue to enjoy the life they want and at the same time be able to save or manage their budget accordingly," according to Dilda.

When is this country going to start teaching financial literacy?

https://www.zerohedge.com/political/36- ... k-paycheck

https://www.bloomberg.com/news/articles ... f=ZMFHsM5Z

Over a third of Americans who make at least $250,000 per year say they're living paycheck to paycheck, which Bloomberg suggests underscores how inflation is 'taking a bigger bite out of Americans' budgets at all ends of the pay spectrum.'

Another interpretation is that Americans makig at least $250,000 - placing them in the top 5% of earners in the country - have horrendous financial literacy.

According to a survey by Pymnts.com and LendingClub, some 36% of households who make at least $250k - nearly 4x the median US salary - devote almost all their income to household expenses. Higher-income households are also more likely to put expenses on credit cards, though they're also more likely to be able to pay off their balance in full.

The most squeezed people in the high-income category are millennials - those in their mid-20s to early 40s. Over half of top earners in that generation report having very little left at the end of each month.

That said, LendingClub is quick to note that paycheck-to-paycheck doesn't necessarily mean hardship - in fact, only 10% of high earners reported issues covering all their household expenses in April - but it does mean they would have to radically adjust their lifestyle in the event their income suddenly goes away.

Housing expenses, which typically take up large chunks of the budgets of wealthier people, have skyrocketed during the pandemic. For example in Orange County, California, a top-tier home cost $1.7 million in April, up from $1.2 million in February 2020, based on Zillow Group Inc. data. A mortgage on that house, assuming a 20% down payment, would cost about $100,000 per year. That’s 40% of a $250,000 annual pre-tax income.

Top earners, even those struggling to pay the bills, are of course much better off than the rest of the nation, which is facing soaring prices for everything from food to gas and electricity. -Bloomberg

Aside from high-earners, 61.3% of all consumers surveyed reported living paycheck-to-paycheck, up 9% from a year earlier, as US consumer borrowing has soared. In March, credit-card balances spiked by the most on record, and non-revolving credit jumped as well.

Meanwhile, 25% of Americans are delaying retirement due to inflation, a new survey by BMO has found.

Putting off retirement plans is mostly due to disrupted savings from increased prices, the survey found. Thirty-six percent of survey respondents have reduced their savings and 21% are putting away less for retirement in order to keep up with growing costs, according to the survey. -CNBC

"We haven’t seen this level of inflation in a very long time, and it’s very daunting," said Paul Dilda, head of consumer strategy at BMO Harris Bank, who added that many people who are either retired or are nearing retirement didn't factor in surging expenses.

Inflation has affected younger Americans the most - with over 60% of those between 18 and 34 years of age reporting that they had to pull back on their savings contributions in order to offset the rising costs.

What are people doing to combat inflation? Americans are dining out less, being more careful at the store, driving less, and canceling or spending less on vacations.

"We’re seeing a lot of people taking those actions so that they can continue to enjoy the life they want and at the same time be able to save or manage their budget accordingly," according to Dilda.

When is this country going to start teaching financial literacy?

https://www.zerohedge.com/political/36- ... k-paycheck

https://www.bloomberg.com/news/articles ... f=ZMFHsM5Z

The Biden Economy: Work 12 Months, Get Paid For 11 !!

Considering that the average income in the USA is $31,133, Living on "leftover" $85,000 is superb!

Considering that the average income in the USA is $31,133, Living on "leftover" $85,000 is superb! - By Tainari88

- By Tainari88 - By wat0n

- By wat0n