- 11 Nov 2018 05:42

#14961984

You did see where he said it has materialized in the stock and real estate market bubbles.

I agree with this.

I notice that nobody can respond to my last post, the 1 on this page.

There I explained why it will not materialize. That is, investors have the dollars and they want to keep them invested. So, if they see the 2 bubbles bursting soon, they will sell their stock and real estate and park their money in US Bonds. If China is selling its Bonds then the investors can buy those Bonds. Then China has a boat load of US Dollars. They can buy other Bonds, like German Bonds; or they can buy stuff from America. This will increase exports. This will reduce the trade deficit. This will [as he says] being the dollars home, but not into the hands of the people but rather into the hands of the owners of the Corps. doing the exporting. Why would they spend them on stuff? Wouldn't they buy US Bonds or maybe invest in making more stuff to sell to China.

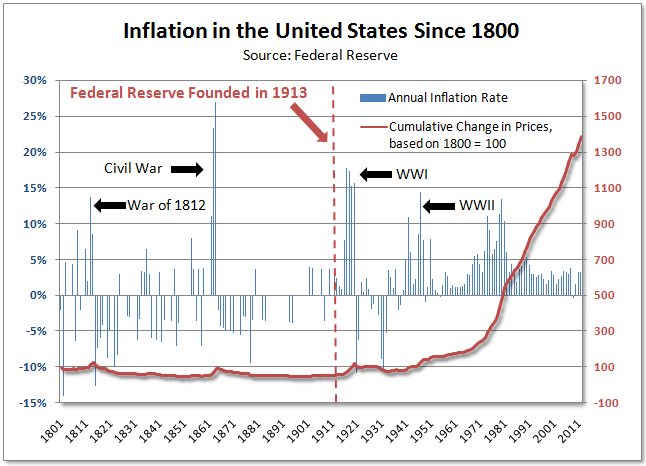

. . However, the increase in exports would [as he says] reduce the supply of that exact types of stuff in America. This might lead to shortages. This could lead to inflation. Under MMT the way to fight this inflation is to raise taxes on someone to suck dollars out of the economy. OTOH, as long as the inflation is around 2-3% it is in line with the target that the Fed. has set.

. . OTOH, didn't China stop buying soybeans from America. This seems like the opposite of buying more from America.

You see, it gets confusing very fast.

I have elsewhere on this forum a few times said that the US can't keep having a trade deficit forever. That we are buying real stuff with paper dollars. How can this go on forever? So far, the world loves US Bonds and dollars. This may change. Then the US will need to reinvest in making its own stuff and more stuff for export. This will create more jobs in America. This is a good thing because despite the official unemployment rate being low there are still a *lot* of people who have part time jobs or have gotten too discouraged to look for work. [I was one of them in 2012. But, I was already on early Soc. Sec. so we lived on that and the wife's wages. Then we decided the hell with this and moved to SE Asia to retire and stretch the SS dollars 3 times further. We live quite well now.]

Rancid wrote:

Why hasn't it materialized?

You did see where he said it has materialized in the stock and real estate market bubbles.

I agree with this.

I notice that nobody can respond to my last post, the 1 on this page.

There I explained why it will not materialize. That is, investors have the dollars and they want to keep them invested. So, if they see the 2 bubbles bursting soon, they will sell their stock and real estate and park their money in US Bonds. If China is selling its Bonds then the investors can buy those Bonds. Then China has a boat load of US Dollars. They can buy other Bonds, like German Bonds; or they can buy stuff from America. This will increase exports. This will reduce the trade deficit. This will [as he says] being the dollars home, but not into the hands of the people but rather into the hands of the owners of the Corps. doing the exporting. Why would they spend them on stuff? Wouldn't they buy US Bonds or maybe invest in making more stuff to sell to China.

. . However, the increase in exports would [as he says] reduce the supply of that exact types of stuff in America. This might lead to shortages. This could lead to inflation. Under MMT the way to fight this inflation is to raise taxes on someone to suck dollars out of the economy. OTOH, as long as the inflation is around 2-3% it is in line with the target that the Fed. has set.

. . OTOH, didn't China stop buying soybeans from America. This seems like the opposite of buying more from America.

You see, it gets confusing very fast.

I have elsewhere on this forum a few times said that the US can't keep having a trade deficit forever. That we are buying real stuff with paper dollars. How can this go on forever? So far, the world loves US Bonds and dollars. This may change. Then the US will need to reinvest in making its own stuff and more stuff for export. This will create more jobs in America. This is a good thing because despite the official unemployment rate being low there are still a *lot* of people who have part time jobs or have gotten too discouraged to look for work. [I was one of them in 2012. But, I was already on early Soc. Sec. so we lived on that and the wife's wages. Then we decided the hell with this and moved to SE Asia to retire and stretch the SS dollars 3 times further. We live quite well now.]

- By Rich

- By Rich