- 15 Jul 2021 05:29

#15181090

Yeah.

I'll add, look at those downward jags -- it looks like a definite *pattern*, if only over three economic crash-type events. The *magnitude* keeps increasing, though the *duration* keeps lessening.

This indicates, to me at least, increasing *fragility* and the need for quicker, larger *responses* to each successive crash.

Thanks -- commentators often forget to address *material output* / productivity, or prevailing 'overproduction', meaning that a greater amount of goods and services already exists in comparison to a *lesser* amount of consumer demand, yielding decreasing / lower prices across-the-board. This corresponds to what we'd *expect*, by the balance of supply-and-demand -- more stuff, less demand equates to a consistently lower interest rate since a glut of capital goods (finance) has already been produced, and there's not-enough activity, demand, or growth in the economy to make the *valuation* of capital (interest rate) rise at all.

Meant to include the following -- it's not 1970s-era productivity anymore....

Potemkin wrote:

Actually, the graph shows that the growth rate of US GDP is stagnant. This is entirely to be expected for a mature capitalist economy.

Yeah.

I'll add, look at those downward jags -- it looks like a definite *pattern*, if only over three economic crash-type events. The *magnitude* keeps increasing, though the *duration* keeps lessening.

This indicates, to me at least, increasing *fragility* and the need for quicker, larger *responses* to each successive crash.

Potemkin wrote:

I can't disagree with that.

Thanks -- commentators often forget to address *material output* / productivity, or prevailing 'overproduction', meaning that a greater amount of goods and services already exists in comparison to a *lesser* amount of consumer demand, yielding decreasing / lower prices across-the-board. This corresponds to what we'd *expect*, by the balance of supply-and-demand -- more stuff, less demand equates to a consistently lower interest rate since a glut of capital goods (finance) has already been produced, and there's not-enough activity, demand, or growth in the economy to make the *valuation* of capital (interest rate) rise at all.

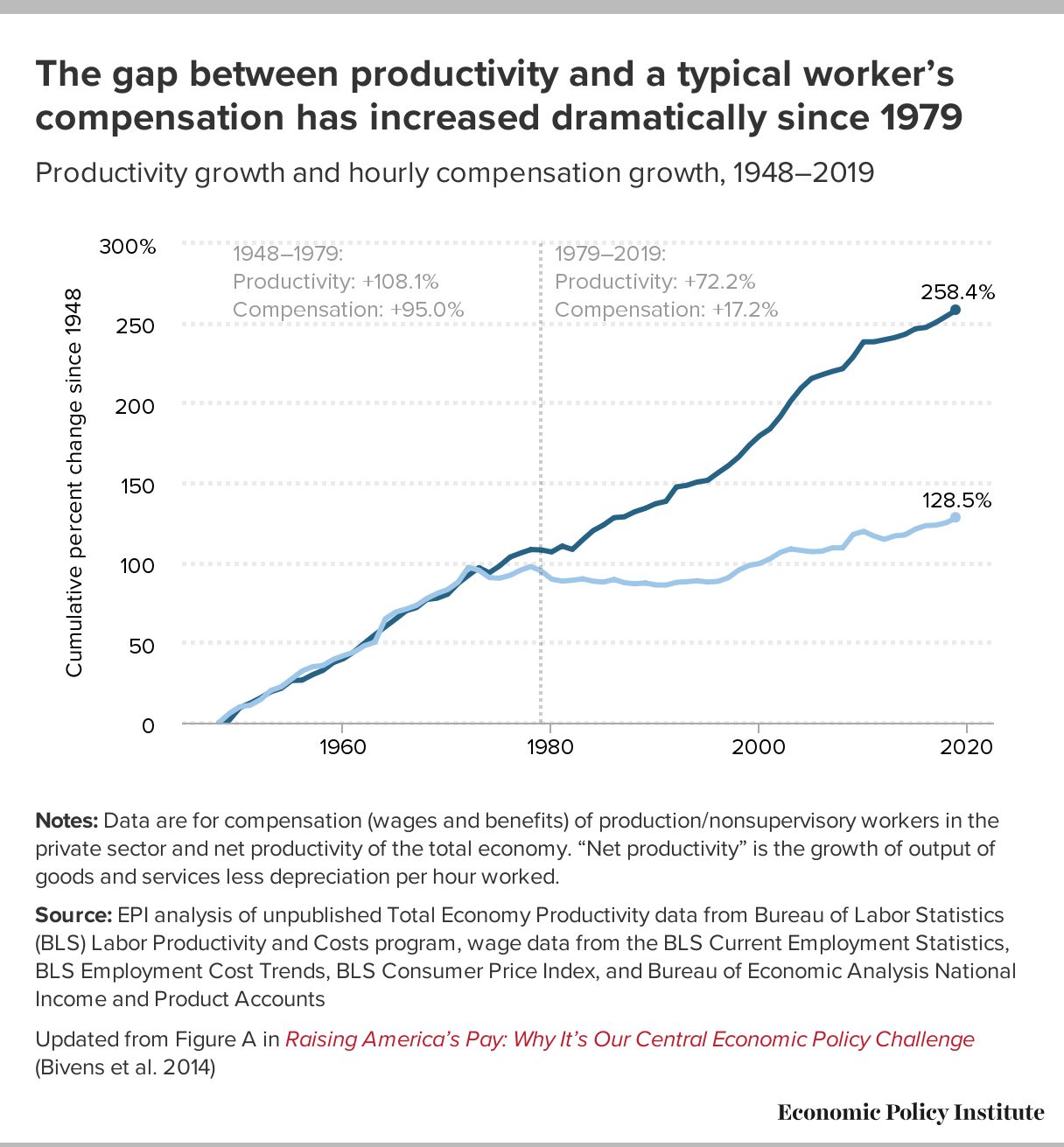

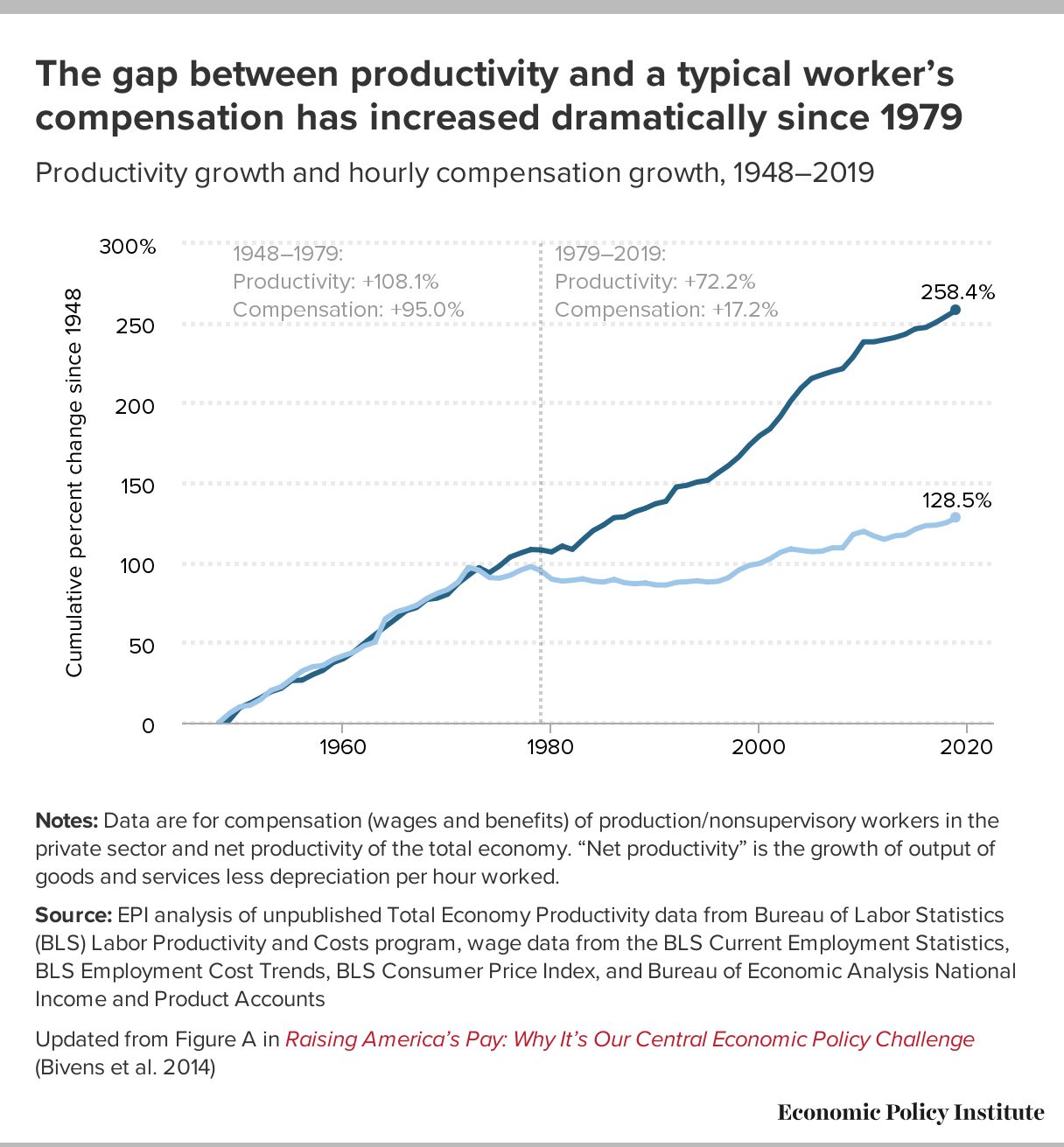

Meant to include the following -- it's not 1970s-era productivity anymore....

- By wat0n

- By wat0n