ckaihatsu wrote:

*negative* interest rates

QatzelOk wrote:

This is the sign that collapse is imminent.

No, it's not, though it's obviously a 'negative' indicator for the health of capitalism.

*I* think the sign that collapse is imminent is the Fed's objective / empirical inability to use the interest rate mechanism anymore. They've already lowered it to near-zero, to purportedly prime-the-pump ('MMT', or rehashed Keynesianism) with cheap government investment capital (to the 'shadow banking' sector).

But creeping inflation in consumption goods since COVID is, to many, a return of pain, and now we have to hear another round of official anxiety about workers wanting more / higher wages, to compensate for their loss of purchasing power.

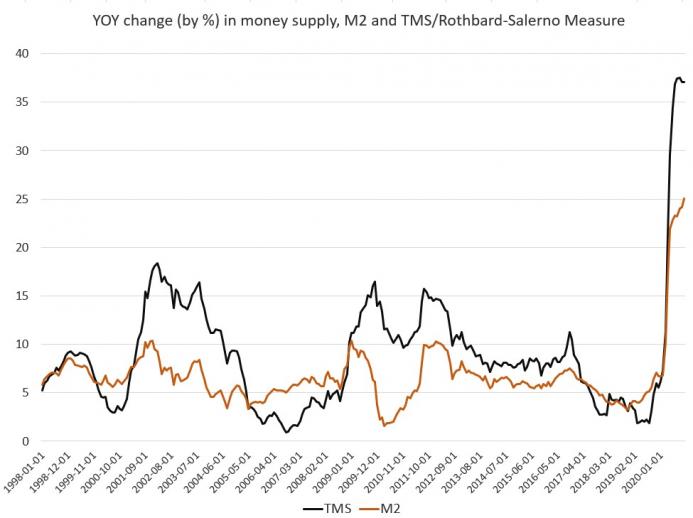

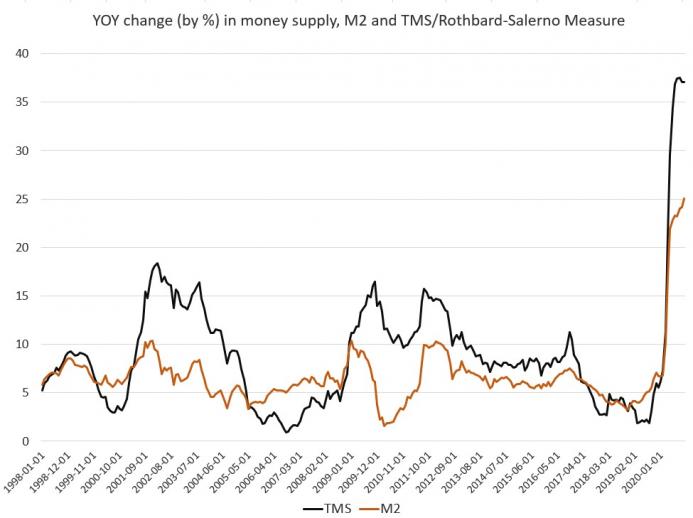

The 'inflation' that the corporate mainstream has been wanting, is *not* CPI -- GDP growth and interest rates ('federal funds rate') have been moribund since the '90s / dotcom crash, so the 2% is Norman-Rockwell-type wishful-thinking about white picket fences and all that.

No, I don't think that central banks would pursue a strategy of 'inflating their debts away' like any given credit card consumer, but I could be wrong on that. I assure you that the intentions behind quantitative easing have been *Keynesian* in outlook.

...Since 2008 the policies of the national reserve banks have insured that savers would be robbed of their wealth through interest rates lower than inflation.

It's ultimately a government *policy* decision -- and now they're out of maneuvering room -- but one has to point out that the world's awash in cash (low interest rates) but sorely lacking any *growth* opportunities to *enlarge* that pool of value. Hence society's uniform dependence on government deficit spending.

They enacted such policy because many nations cannot pay normative interest rates on their national debt. They will continue this policy until they either run out of other people's money or the value of paper money is inflated away like is now happening in Venezuela...

No, sorry, the U.S. and Venezuelan economies are not comparable. The U.S. enjoys the world's reserve currency status, which no one should tire of highlighting. It's really the coin-of-the-realm, or whatever, and all other economies have to line-up to it, the U.S. dollar.

Btw:

Top Court Allows Venezuela’s Juan Guaido to Assert Control of $1 Billion Gold

https://finance.yahoo.com/news/top-cour ... 53559.htmlI think the whole world now understands that there is *zero* hope of any kind for a real *repayment* on national debts, given how much the overhang is now, generally, and with low-to-zero prospects for any kind of renewed economic growth to *fund* such repayments.

... "ooooh, he's going to fall... he's going down!... what? nooooo! how did he manage not to fall?!?!"

... "ooooh, he's going to fall... he's going down!... what? nooooo! how did he manage not to fall?!?!"

- By Rich

- By Rich