ckaihatsu wrote:

No, it doesn't, mostly because money's *valuation* is not the same as its *face values*.

Truth To Power wrote:

Gibberish. Value is what something would trade for, and money is what is generally accepted in trade, so value is measured in money. Your claim is like saying the length of a meter is not the same as how long it is.

Of *course* value is measured in money -- I prefer the term 'exchange value'.

*But*, would you say that currency is totally *inert* -- ? Is it really as 'neutral' as you make it out to be -- ?

I'll maintain that currency has *two* different valuations, its *face value*, and then its *market* value:

The face value of coins, stamps, or bill is usually its legal value. However, their market value need not bear any relationship to the face value. For example, some rare coins or stamps may be traded at prices considerably above their face value. Coins may also have a salvage value due to more or less valuable metals that they contain.

https://en.wikipedia.org/wiki/Face_value

And:

The 2018–2022 Turkish currency and debt crisis (Turkish: Türkiye döviz ve borç krizi) is an ongoing financial and economic crisis in Turkey. It is characterized by the Turkish lira (TRY) plunging in value, high inflation, rising borrowing costs, and correspondingly rising loan defaults. The crisis was caused by the Turkish economy's excessive current account deficit and large amounts of private foreign-currency denominated debt, in combination with President Recep Tayyip Erdoğan's increasing authoritarianism and his unorthodox ideas about interest rate policy.[1][2][3][4] Some analysts also stress the leveraging effects of the geopolitical frictions with the United States. Following the detention of American pastor Andrew Brunson, who was confined of espionage charges after the failed 2016 Turkish coup d'état attempt, the Trump administration exerted pressure towards Turkey by imposing further sanctions. The economic sanctions therefore doubled the tariffs on Turkey, as imported steel rises up to 50% and on aluminium to 20%. As a result, Turkish steel was priced out of the US market, which previously amounted to 13% of Turkey’s total steel exports. [5][6]

While the crisis was prominent for waves of major depreciation of the currency, later stages were characterized by corporate debt defaults and finally by contraction of economic growth. With the inflation rate stuck in the double digits, stagflation ensued. The crisis ended a period of overheating economic growth under Erdoğan-led governments, built largely on a construction boom fueled by foreign borrowing, easy and cheap credit, and government spending.[7]

After a period of modest recovery in 2020 and early 2021 amid the COVID-19 pandemic, the Turkish lira plunged following the replacement of Central Bank chief Naci Ağbal with Şahap Kavcıoğlu,[8] who slashed interest rates from 19%[9] to 14%.[10] The lira lost 44% of its value in 2021 alone.[11]

https://en.wikipedia.org/wiki/2018%E2%8 ... ebt_crisis

---

Truth To Power wrote:

No, I'm saying that the consumer's desire to get things at lower prices does not affect the information that generates the market price.

ckaihatsu wrote:

But just a *moment* ago you said:

Truth To Power wrote:

Consumer utility is only relevant to value and price to the extent that is expressed in demand.

Truth To Power wrote:

And I was correct: only desire backed with willingness and ability to pay counts as demand in the market.

What's at-issue here in my estimation is whether the consumer has any *bearing*, and *passive influence* (times 'x'-number of like-positioned consumers) on market pricing. The simple economic fact that the consumer has an intrinsic interest in *lower prices* means that they're *definitely* stakeholders in the economic exchange and will favor *lower prices* in the market, *impacting* the market's general pricing for any given item -- 'supply and demand'.

ckaihatsu wrote:

So the point here is 'Does the consumer's interest for lower prices affect the *demand-side* of the economic exchange at all -- ?'

Truth To Power wrote:

Sure: it's recorded in how much they are willing to pay for stuff. Not how much they would prefer to pay.

Okay, thank you. That clarifies things with regard to the above because you had also made *this* statement, which is *contradictory*.

Truth To Power wrote:

No, I'm saying that the consumer's desire to get things at lower prices does not affect the information that generates the market price.

---

ckaihatsu wrote:

Does consumer economic demand *impact* on value and price at all -- ?

Truth To Power wrote:

Of course, because demand IS what the buyers are willing and able to pay.

(See the previous segment.)

ckaihatsu wrote:

I'm arguing that consumer economic demand *does* affect the market-pricing information that's part and parcel of the markets mechanism. Greater demand, as for petroleum or natural gas, will enable the seller to fetch *higher prices* than usual, 'profiteering', thanks to the markets' responsiveness to the value of *money*, overshadowing the consumer's interest for realistic / affordable *pricing* for what they need to buy for their lives and living.

Truth To Power wrote:

You are confused because you are conflating desire and utility with demand.

(See the previous.)

ckaihatsu wrote:

Market pricing is not *nearly* as simple as straight supply-and-demand. There are many *other* factors in the mix that affect moment-by-monent prices, so that no one can really say that market prices are 'pure', or 'dependable', really, even -- note Evergreen, etc.

Truth To Power wrote:

You are confused because you are a Marxist, and thus do not know what supply and demand are. All you know are Marxist anti-concepts concocted to prevent use of valid concepts.

Since you object to 'Marxist concepts', I'll use plain language to say that market pricing is *hardly* described adequately by simple supply-and-demand dynamics *solely* -- note the Turkish lira currency update above, where the article clearly notes the regular factors of [1] excessive current account deficit, [2] private foreign currency denominated debt, [3] lowered interest rates, [4] geopolitics / tariffs.

---

ckaihatsu wrote:

No-dependable-markets means there's *no meritocracy* to the economy,

Truth To Power wrote:

Any time a producer is paid the market price for goods or services he caused to be produced, there is meritocracy in the economy.

Where is the *value judgment* coming from -- from *qualitative*, let's-put-our-money-on-the-most-deserving-company kind of *quality*-based criteria, or is it let's-put-our-money-so-that-it-makes-more-money.

As noted previously, the capitalist political economy doesn't run on betting-on-the-right-horse, as may be *intuitively* felt, but rather on 'Can I get a *return* from this.'

That's *flows of capital*, and *not* roundtable brainstorming on which potential property should get the 1st-place blue-ribbon.

ckaihatsu wrote:

and definitely no 'accurate' pricing regime, thanks to interceding market-mechanism *exchanges* on the road from the manufacturer to the consumer.

Truth To Power wrote:

Gibberish. There is no price more "accurate" than the market price based on consensual exchange.

It's not your delicate civil *sensibilities* that are being ruined here -- it's that every time a middleman shows up with a bag of cash for a piece of the action, that's just one more hand in the till, providing arguable 'financial services' (internal labor) for the company's revenue stream.

Consider *government intervention* in the markets -- would *big players* like the U.S. government usually cause *disruptions* to regular market pricing -- ?

ckaihatsu wrote:

Of course I *don't agree* with your opinionating here -- I maintain that one commodity's market 'price' will be functionally stretched *too thin* to cover the disparate interests of the [1] equity investor, [2] commodity speculator, and [3] consumer.

Truth To Power wrote:

Gibberish. Their "interests" are irrelevant. All that matters is how much they are willing and able to pay or accept.

You're *sidestepping* that this is about the *pricing* valuation under capitalism -- one singular value is not sufficient information for three different stakeholder parties with three different private-interest strategies.

ckaihatsu wrote:

This means that the resulting price itself is a *zero-sum game* -- higher post-production prices will benefit the *investor* and *speculator*, but not the consumer. *Lower* prices will benefit the *consumer*, but not the investor.

Truth To Power wrote:

Captain Obvious.

ckaihatsu wrote:

So 'cost', and/*or* 'price'. It's *not* either-or, as you're positing.

Truth To Power wrote:

I said no such thing. Sometimes price is close to production cost, other times it isn't.

ckaihatsu wrote:

What the hell is a 'non-market pricing arrangement' -- ?

Truth To Power wrote:

Controlled prices, such as under socialism, where prices are assigned by officials based on some criterion other than the terms of consensual exchange.

Yup -- here's my standing *critique* of that:

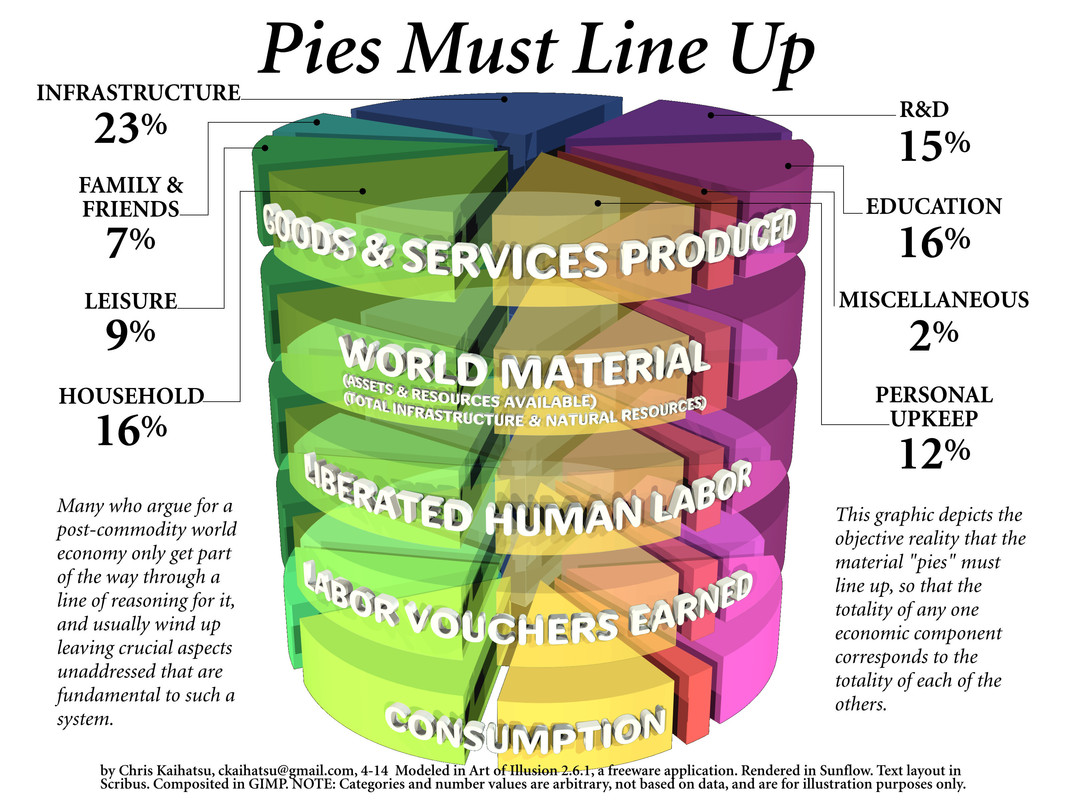

Pies Must Line Up

---

ckaihatsu wrote:

You were just *touting* the bounty of *market* pricing arrangements:

Truth To Power wrote:

Then money does the job just fine.

Truth To Power wrote:

Correctly.

(See earlier in the post.)

- By Fasces

- By Fasces - By Tainari88

- By Tainari88