Bankman-Fried. Well he would know!!

- - - -

Bankman-Fried Secretly Cashed Out $300 Million During FTX Funding Spree

Friday, Nov 18, 2022 - 03:46 PM

One can read SBF's latest, excruciatingly grating and self-serving twitter thread in 32 parts...

32) Anyway -- none of that matters now.

What matters is doing the best I can.

And doing everything I can for FTX's customers.

— SBF (@SBF_FTX) November 16, 2022

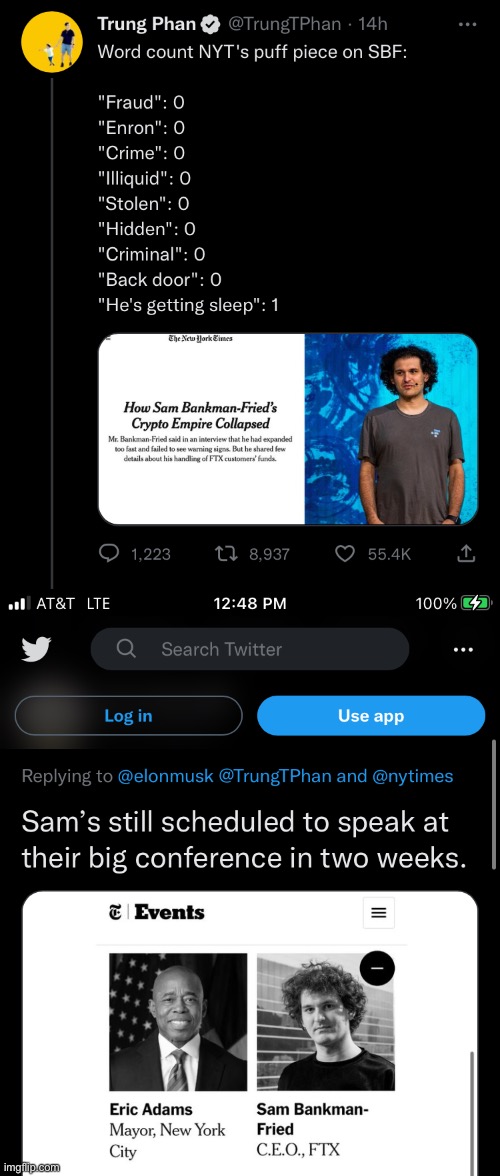

... which is heavy in self-pity and material, self-incriminating evidence that will be used by the prosecution, which even the FTX liquidator tried urgently to distance the now bankrupt company from...

but sadly light on how SBF commingled and swindled billions in client funds, a question over a million FTX "creditors" demand an answer to immediately if only to get closure on how they all got "Ccompletely orzined" (speaking of other popular democrats).

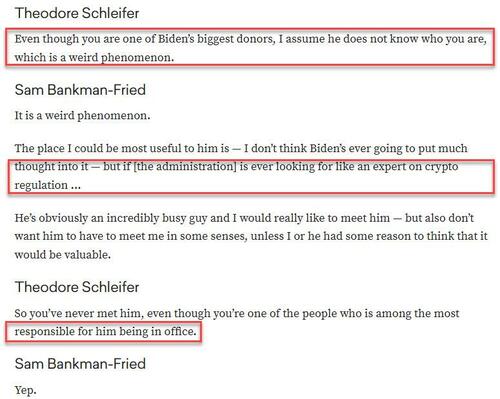

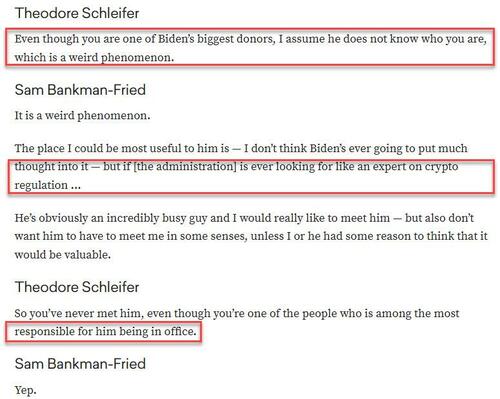

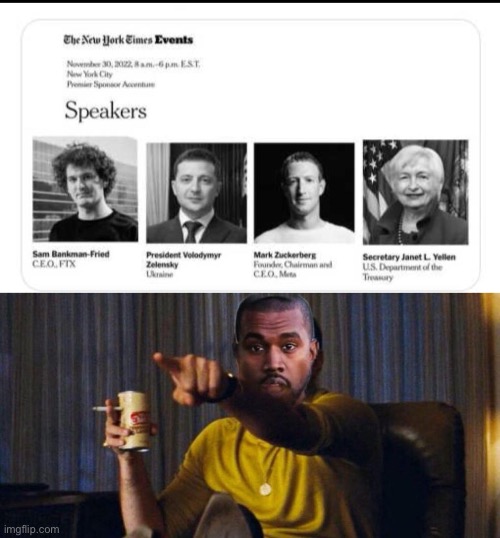

And while we wait for more information from the FTX liquidator on how the 30-year-old Democrat who "got Biden elected"...

... pilfered and pillaged the company with an $8 billion shortfall, moments ago the WSJ disclosed another nefarious, self-enriching scheme by the Bahamas-based sociopath. According to the Journal, besides commingling and stealing client funds, Sam Bankrupt-Fraud also lied to investors that FTX was holding a primary stock offering when it was really conducting a secondary.

When FTX raised $420 million from an array of big-name investors in October last year right around the peak of the crypto bubble, at an FTX valuation of $25 billion, the cryptocurrency exchange said the money would help grow the business, improve user experience and allow it to engage more with regulators. In other words, a pure primary offering.

But as the Journal reports, what was left unmentioned was that nearly three-quarters of the money, $300 million, went instead to FTX founder Sam Bankman-Fried, who sold some of his personal stake in the company, according to FTX financial records reviewed by The Wall Street Journal. In other words, what was repped & warranted as a primary offering was really most a secondary. Which of course is completely criminal but in SBF's case it just means "get in line."

SBF's sale of stock in October 2021 came in the midst of a six-month fundraising blitz that ultimately brought in roughly $2 billion from investors including Sequoia Capital, funds managed by BlackRock and the Singapore sovereign wealth fund Temasek.

The October 2021 fundraising valued the company at $25 billion. In a press release, Bankman-Fried said he was happy “to partner with investors that prioritize positioning FTX as the world’s most transparent and compliant cryptocurrency exchange." Of course, it ended being everything but.

The amount raised contained numerical references to marijuana and oral sex: $420.69 million raised from 69 investors. An article published by one of FTX’s investors, Sequoia, called that fundraising a “meme round,” referring to the embedded jokes.

Three months earlier, in July 2021, Bankman-Fried bought out the roughly 15% stake owned by Binance, FTX’s first outside investor. Binance CEO Changpeng Zhao tweeted this month that the amount totaled $2.1 billion, paid in a combination of FTT, FTX’s in-house crypto currency, and BUSD, Binance’s stablecoin, whose value is pegged to the U.S. dollar.

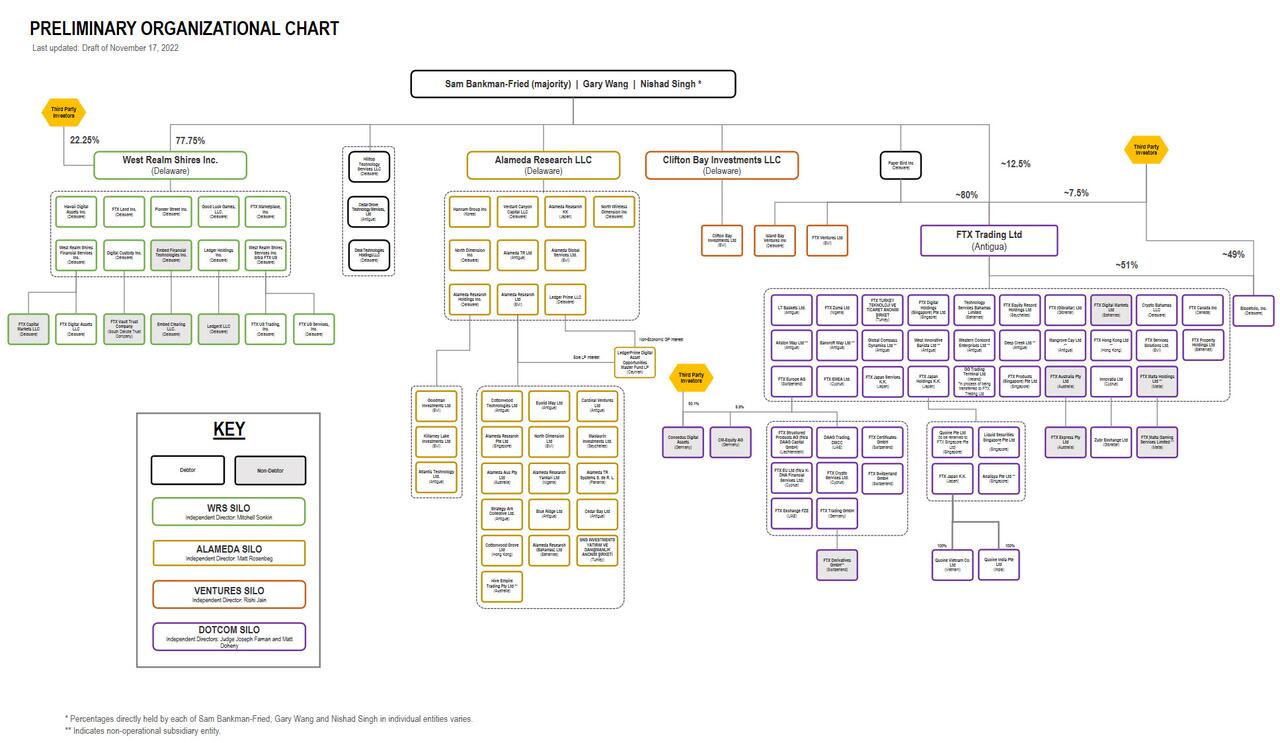

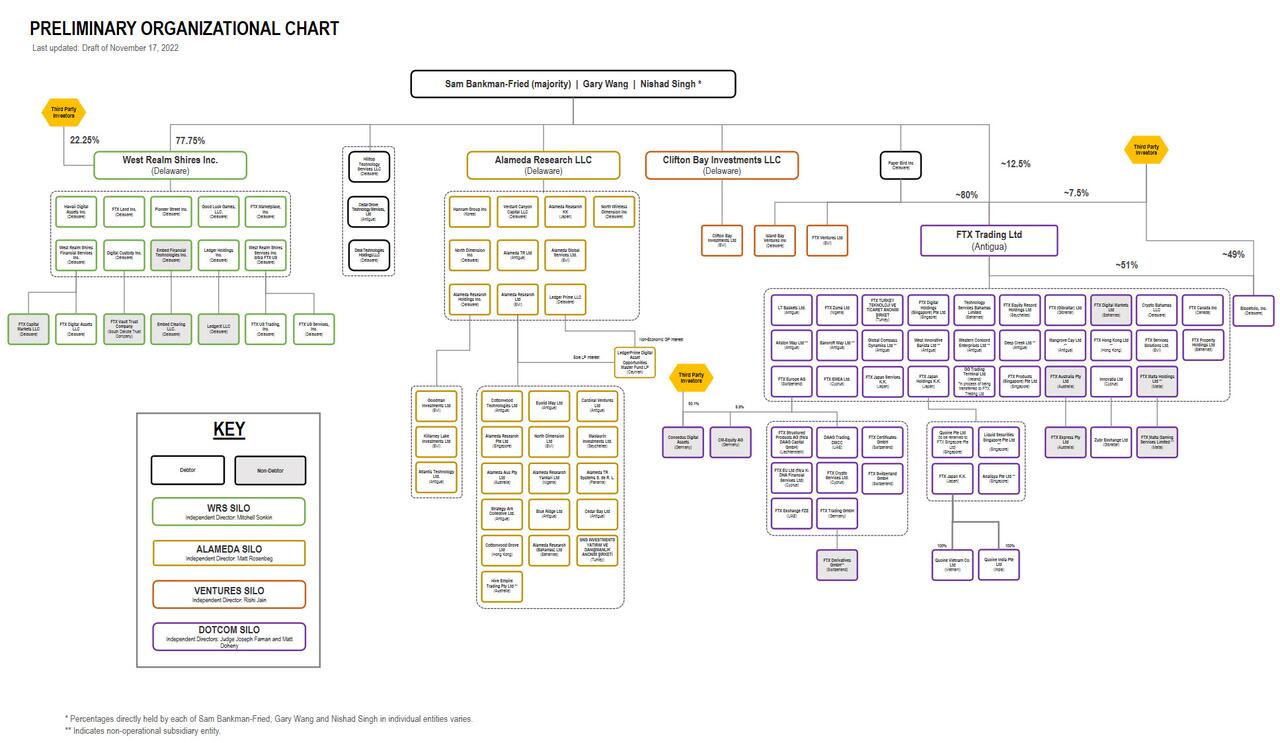

After the July 2021 sale, the FTX shares Binance previously owned ended up in Paper Bird Inc., according to FTX documents. Paper Bird is an entity 100% owned by Mr. Bankman-Fried, according to documents on FTX filed with Miami-Dade County, in Florida.

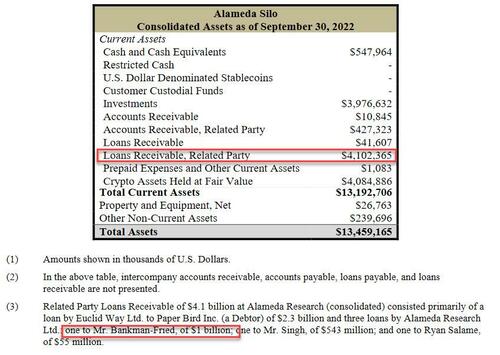

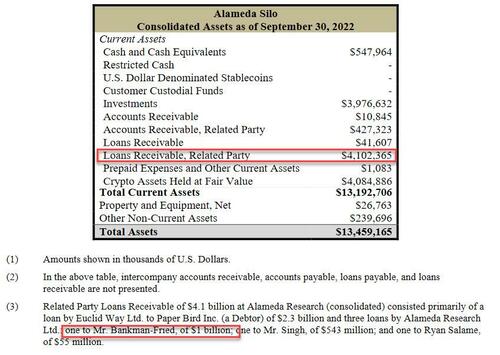

Which means that in addition to the direct $300 million cash out, SBF also siphoned off $3.3 billion in "related party receivables" - as we noted yesterday, we already knew that $1 billion went directly to Bankman-Fried.

We can now add the $2.3 billion to Paper Bird as part of SBF's total, bringing the total to $3.6 billion that we know of so far.

As the WSJ adds, Bankman-Fried’s equity sale fraud, er, cashout was large by startup-world standards, where such sales historically were taboo because they allow founders to reap profits before investors. Bankman-Fried told investors at the time it was a partial reimbursement of money he spent to buy out rival Binance’s stake in FTX a few months earlier, according to some of the people familiar with the transaction.

Additionally, the deal offers an explanation for the extremely complicated FTX org chart, whose purposes was to obfuscate fund flows...

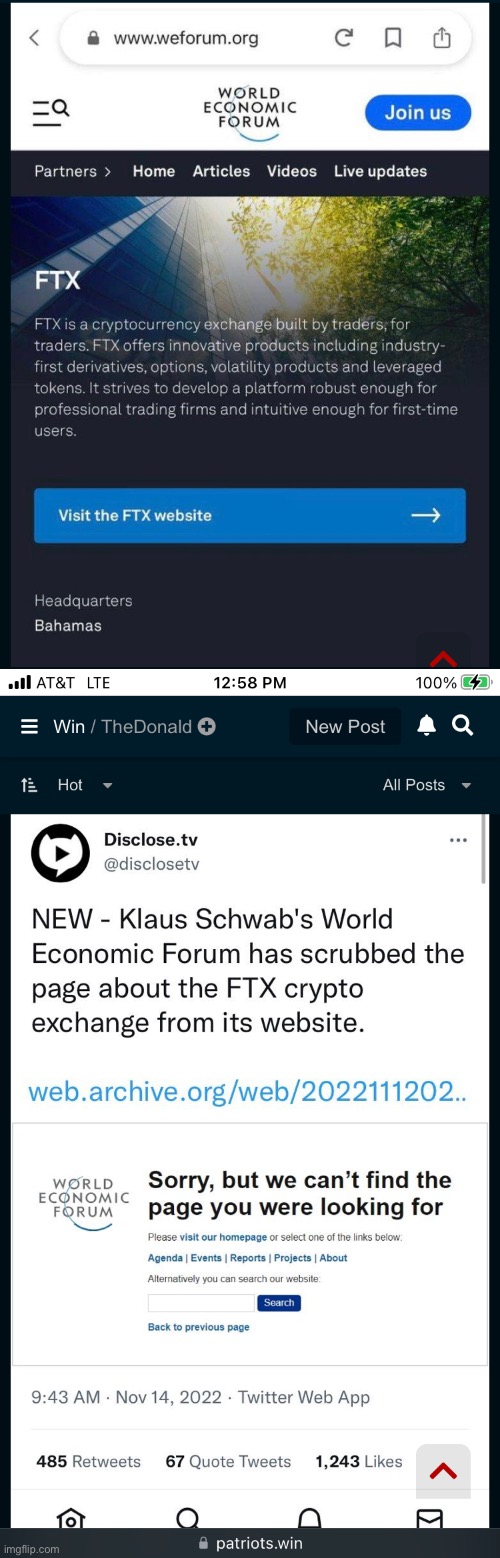

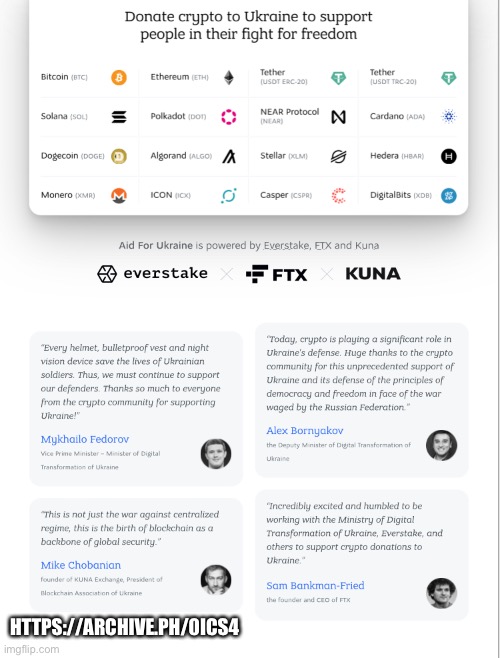

... and to enable the transfer of money between Bankman-Fried and multiple entities he controlled while his crypto business flourished, a funding stream that helped finance a burst of Democratic political donations, "philanthropic" commitments and a large purchase of Robinhood Markets stock in the past year, all in hopes of masking the epic fraud taking place behind the scenes and greenwashing his political influence which SBF took to mean a perpetual get out of jail card signed by the democrats in return for his "generosity" with stolen funds.

... and to enable the transfer of money between Bankman-Fried and multiple entities he controlled while his crypto business flourished, a funding stream that helped finance a burst of Democratic political donations, "philanthropic" commitments and a large purchase of Robinhood Markets stock in the past year, all in hopes of masking the epic fraud taking place behind the scenes and greenwashing his political influence which SBF took to mean a perpetual get out of jail card signed by the democrats in return for his "generosity" with stolen funds.Of course, that swirl is now under scrutiny in the massive $10-$50BN bankruptcy of FTX and Alameda Research, Bankman-Fried’s crypto hedge fund. FTX, which lent customer funds to Alameda, faces a funding gap of roughly $8 billion, Alameda and FTX executives have said.

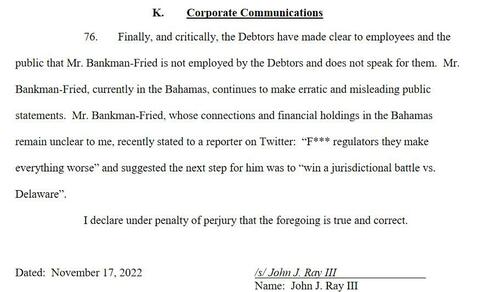

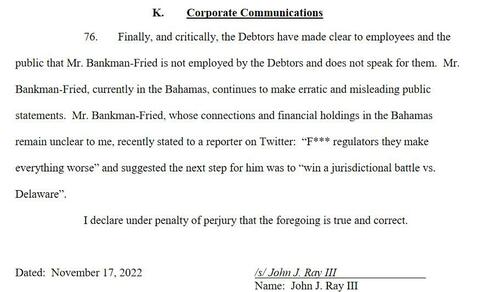

John Ray, FTX’s new chief executive installed to oversee the bankruptcy, said in a court filing Thursday the process would involve the “comprehensive, transparent and deliberate investigation into claims against Mr. Samuel Bankman-Fried” and other cofounders of the entities.

The filing highlighted numerous failings, including “the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals.”

SOURCE:

https://www.zerohedge.com/markets/bankm ... ding-spree

- By Pants-of-dog

- By Pants-of-dog - By Rancid

- By Rancid