Puffer Fish wrote:I think by this you mean that you do not agree that printing more money causes inflation.

That seems to be what your MMT theory says.

To me, however, that sounds like you are trying to get something for nothing, to "have your free lunch", as economics would put it.

If you don't believe printing money causes inflation, then it would hardly be that surprising that you would oppose allowing interest rates to rise to try to help fight inflation.

So far, so good? Tell me if I am wrong about any of this.

Basically, yes that is what MMT asserts.

MMTers point to Japan as their example that it is not true that what you want to call 'printing money' will always in every case lead to inflation.

MMters don't call it printing money because it factually isn't done that way any more. Now it is done by crediting bank accounts directly with more money. Sometimes by sending a check through the mail.

However, I take exception to your "something for nothing" worry. Somehow, mainstream economists don't seem to worry about the rich getting money for nothing. It is only when it is the working class getting it do they worry. So, they can increase the defense spending with abandon for example.

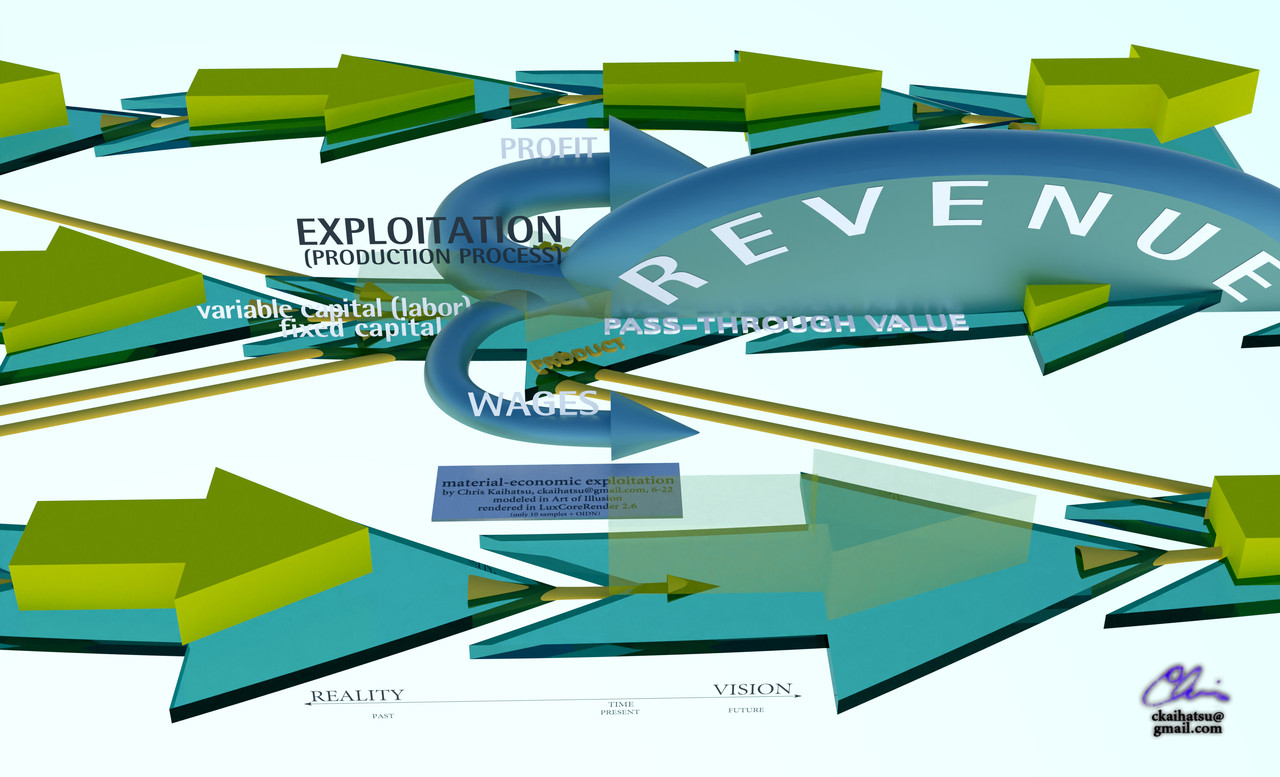

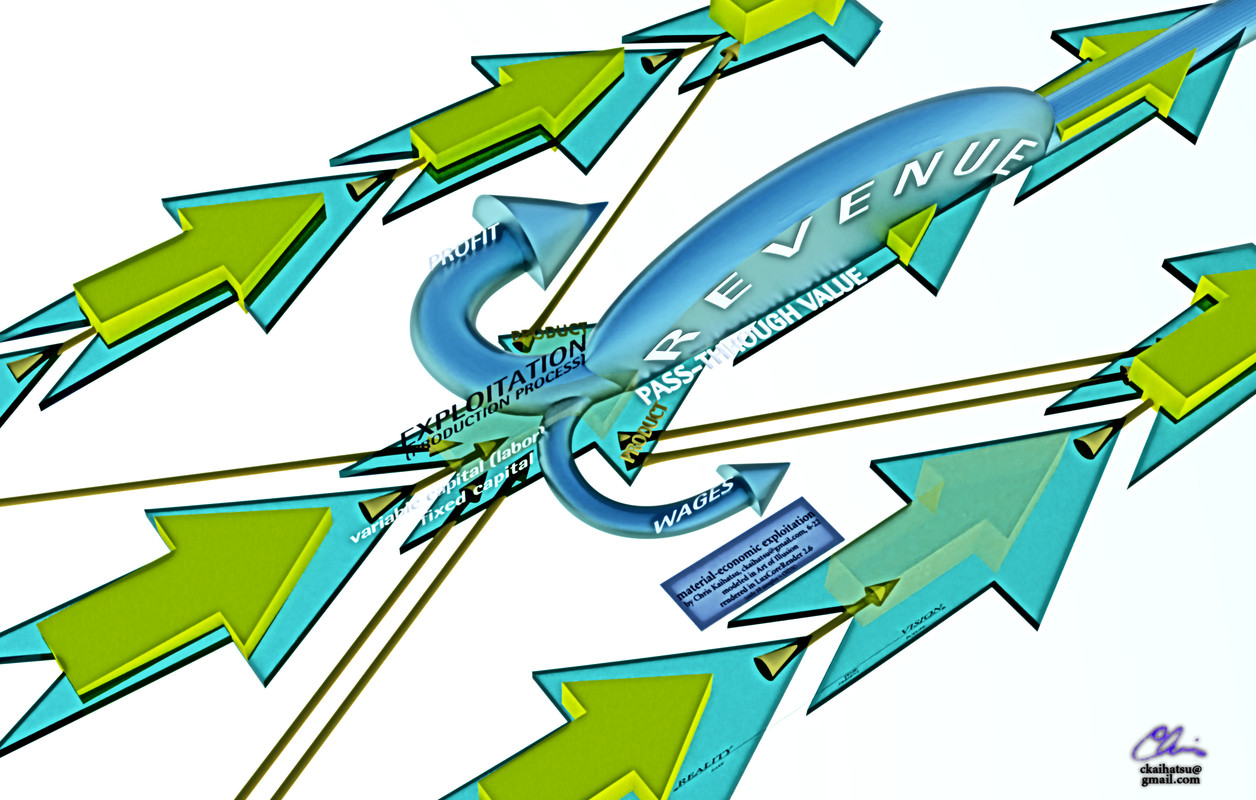

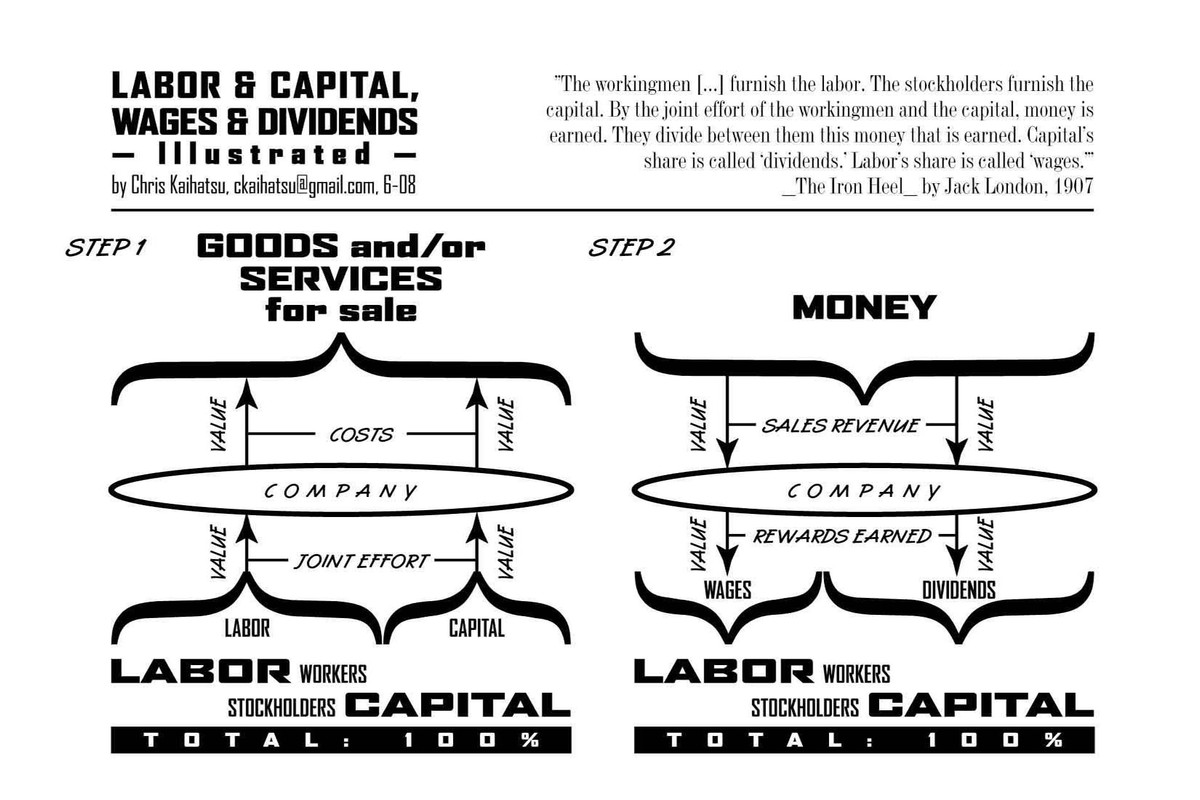

MMT controls inflation with its automatic system that includes the Job Guarantee Program. The JGP will increase the wages that must be paid by corps which will reduce their profits. But, IMHO profits are insane now. No economy can increase profits every year for 100 years. OTOH, the JGP will add to demand which businesses with deficit spent money and corps can take it out of the economy increasing their sales. MMT would also breakup the monopolistic corps. I would have a graduated corporate revenue tax that is very steep at some point to keep corps from getting too large. I myself would tax revenue because they can't hide revenue, overseas for example. For example if Amazon had to pay 20% of its revenue in tax off the top, smaller corps could charge less and take its business away. 20% may be too much or not enough. I am not sure what is right. Also, it might be on revenue less wages paid to hourly American workers.

.

- By Tainari88

- By Tainari88