- 28 Jan 2019 15:51

#14983769

As Theresa May is fighting to survive, let us look back on what have the Tories achieved the past 9 years in government.

Taxes & Benefits

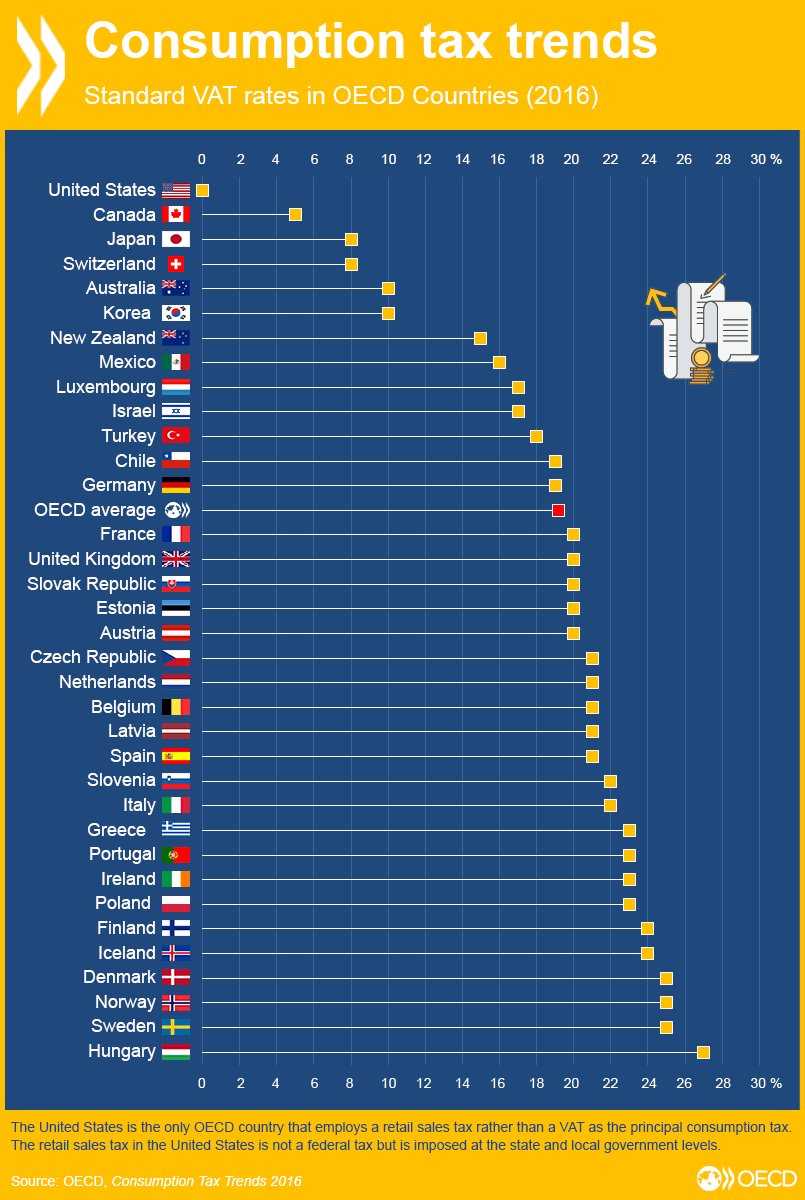

As soon as they took over in 2010, they slashed corporate taxes from 21% to 20% with a promise to reduce them further to 17% which they have now announced they will be doing shortly. At the same time they increased the VAT rate from 17.5% to 20%, effectively taking away money from the poor by increasing the VAT on basic items while giving it away as a tax-break to corporations by reducing their corporate tax bill.

During these 8 years they also overhauled the benefit system, introducing what they call universal credit aggregating all benefits under a single roof, which has reduced benefit payments to poor families quite a lot. You can read more about the impact it has had here: https://news.sky.com/story/what-impact- ... g-11343838

Education

They raised the university fees from 3000 per year to 9000 per year in 2010. At the same time they introduced an interest-rate on student loans which were previously interest-free. The interest rate was the RPI(retail price index) + 3% depending on salary, currently the interest rate stands at around 6%.

It is quite funny that the Government raises the pensions per year but instead of raising them in line with the RPI, she raises them in line with the CPI(Consumer Price Index) which is far lower than the RPI. For example the CPI was 2.7% for the year ending 2017 while the RPI was 4.1% for the year ending 2017.

So your government pension increases by 2.7% while your government loan by 4.1% + 3%

Taxes & Benefits

As soon as they took over in 2010, they slashed corporate taxes from 21% to 20% with a promise to reduce them further to 17% which they have now announced they will be doing shortly. At the same time they increased the VAT rate from 17.5% to 20%, effectively taking away money from the poor by increasing the VAT on basic items while giving it away as a tax-break to corporations by reducing their corporate tax bill.

During these 8 years they also overhauled the benefit system, introducing what they call universal credit aggregating all benefits under a single roof, which has reduced benefit payments to poor families quite a lot. You can read more about the impact it has had here: https://news.sky.com/story/what-impact- ... g-11343838

Education

They raised the university fees from 3000 per year to 9000 per year in 2010. At the same time they introduced an interest-rate on student loans which were previously interest-free. The interest rate was the RPI(retail price index) + 3% depending on salary, currently the interest rate stands at around 6%.

It is quite funny that the Government raises the pensions per year but instead of raising them in line with the RPI, she raises them in line with the CPI(Consumer Price Index) which is far lower than the RPI. For example the CPI was 2.7% for the year ending 2017 while the RPI was 4.1% for the year ending 2017.

So your government pension increases by 2.7% while your government loan by 4.1% + 3%

EN EL ED EM ON

...take your common sense with you, and leave your prejudices behind...

...take your common sense with you, and leave your prejudices behind...

where as any one that has spent five minutes researching Iraq's history knows that one thing that Saddaam never brought was stability. He massacred the Baath Party leadership in his seizure of power and in months launched a war against Iran.

where as any one that has spent five minutes researching Iraq's history knows that one thing that Saddaam never brought was stability. He massacred the Baath Party leadership in his seizure of power and in months launched a war against Iran. - By JohnRawls

- By JohnRawls - By Tainari88

- By Tainari88