Consumption taxes promote monopoly. A company does not have to pay income taxes until it turns a profit, but it has to pay sales taxes right off the bat. Thus, it comprises an entry barrier for entrepreneurs seeking to set up shop. Sales taxes also promote non-purchase alternatives as a way of avoiding the tax -- people will be more likely to do trades rather than transactions that would have to be taxed. In addition, if the tax is high enough, businesses with underpaid employees might have an incentive to wink at employee "shrinkage"(i.e. stealing), as well as offering lower prices to those who "don't need a receipt." There are a number of ways in which sales tax can be evaded, and to the extent that one relies on sales tax for revenue, this means having to raise the tax, thus further harming the economy. This is all leaving out the most obvious reason for liberals to oppose a consumption tax: It's regressive.

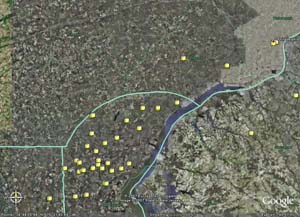

The sales tax becomes even more of a disadvantage if it's different across bordering areas. Here is a Google Earth image of the border between Pennsylvania and Delaware:

The yellow dots represent shopping malls. Pennsylvania has a 6% sales tax, while Delaware has none. Delaware is able to attract a lot of business from its neighbors across the state line. This in turn raises property values, which allows Delaware to raise more revenue even from a lower property tax. A similar pattern could be seen on the border between Massachusetts, which relies heavily on sales tax, and New Hampshire, which mostly uses local property taxes.

As for the VAT of those European countries, I'm sure their strong labor laws help somewhat in reducing some of the negative effects, but I think they'd be better off without it.

Seriously? You're going to argue that those who aren't earning money need any extra encouragement to go earn some money? Every heard of involuntary unemployment? Or do you just think that recessions are instances of large amounts of people taking a vacation?

Seriously? You're going to argue that those who aren't earning money need any extra encouragement to go earn some money? Every heard of involuntary unemployment? Or do you just think that recessions are instances of large amounts of people taking a vacation? - By KurtFF8

- By KurtFF8 - By Rich

- By Rich - By JohnRawls

- By JohnRawls